By Steve Tepper, CFP®, MBA

Ah, for lack of a crystal ball! With constant chatter for more than a year now of a coming recession, how simple it would be to profit if we knew exactly when the recession was going to begin and when it would end.

Or would it be that simple?

History tells a different story. In fact, markets move just based on the possibility of a recession. Often, by the time a formal determination is made that we are in a recession, capital markets have already fallen so much that an advantage might be hard to gain by trading on the news.

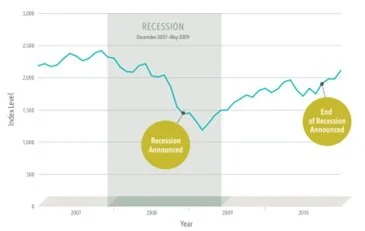

Similarly, the official announcement that a recession has ended often comes after markets have recouped much of their losses. The table below illustrates what your results would have been had you timed the market and sold off your equity position in 2008 following the announcement that the economy was in a recession, and then entered back in after the 2010 announcement that the recession was over.

U.S. Recession and Stock Performance During the Global Financial Crisis[1]

S&P 500 Index, January 2007–December 2010

[1] Start and end dates of US recessions, along with announcement dates, are from the National Bureau of Economic Research (NBER).

The S&P 500 had been falling slowly but consistently for about a year from 2007 to 2008 when the collapse of Bear Sterns and Lehman Brothers sent markets into a freefall. Yet at that time, there had not been a confirmation we were in a recession. By the time that news was confirmed in December 2008, the S&P had already fallen more than 40%!

If you exited the market at that time and waited for the news that the economy was once again expanding, you would have been on the sidelines for nearly two years, until September 2010. By then, the S&P had rebounded from its recession low and was about 50% higher than your exit point! In fact, the low market point occurred 18 months earlier in March 2009, and markets had steadily recovered that whole time that you would have been sitting uninvested.

The 2008 global financial crisis was not unique. There is usually a great lag between the beginning and end of a recession and the official news of such. According to the National Bureau of Economic Research (NBER), the last six recessions were announced, on average, 234 days after the point that the recession actually began. And in five of the last six recessions, the end-of-recession announcement came more than a year after the actual end.

It is not even uncommon for the announcement of a recession to be made after the recession has already ended! This happened just two years ago, during the Covid shutdown. Looking back, we know the recession began in February 2020 and ended just two months later in April. Yet the announcement of the beginning came in June, and the end wasn’t recognized until July 2021!

If you want to time markets, clearly formal announcements of recessions and recoveries are not a winning strategy. What is a winning market timing strategy? When I find it, I’ll let you know!

Sources:

Dimensional Fund Advisors

Calling A Recession: How Long Does It Take? By Rob Minto, Newsweek, 8/19/22

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.