By Wes Crill, PhD, Dimensional Fund Advisors

Non-U.S. stocks have delivered a positive return thus far in 2025, helping offset the U.S. stock market’s disappointing start to the year. But some of the sources for these positive returns may be surprising to investors.

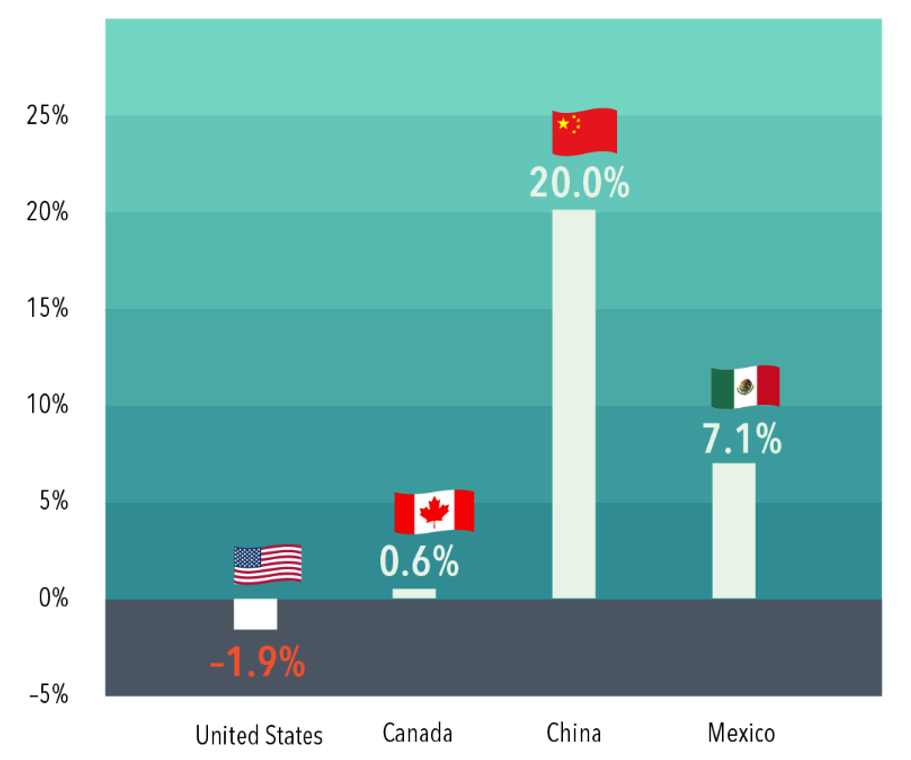

Potential fallout from tariffs has dominated the news cycle, and yet stocks of the primary targets for tariffs—Canada, Mexico, and China—are up for the year. A short sample for sure, but this echoes outcomes during Trump’s first term in office, when the Chinese stock market outperformed the U.S. despite contentious trade discussions throughout those four years.

The lack of negative impact on tariff-target stock markets doesn’t mean investors have tuned out trade policy discussions. Market prices incorporate the aggregate expectations of investors. It could be that tariff developments thus far were in line with those expectations and therefore already priced in by the market.

Index Returns in Local Currency

Year to date as of March 7, 2025

Past performance is not a guarantee of future results. Actual returns may be lower.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.