From Wes Crill, Dimensional Fund Advisors

U.S. stocks outpaced non-U.S. stocks in the first seven months of 2023, adding another data point to a decade-long stretch of U.S. market dominance. While some investors may see this as further reason to question the benefit of global diversification, it’s important to note how much of this year’s U.S. advantage stemmed from a handful of stocks.

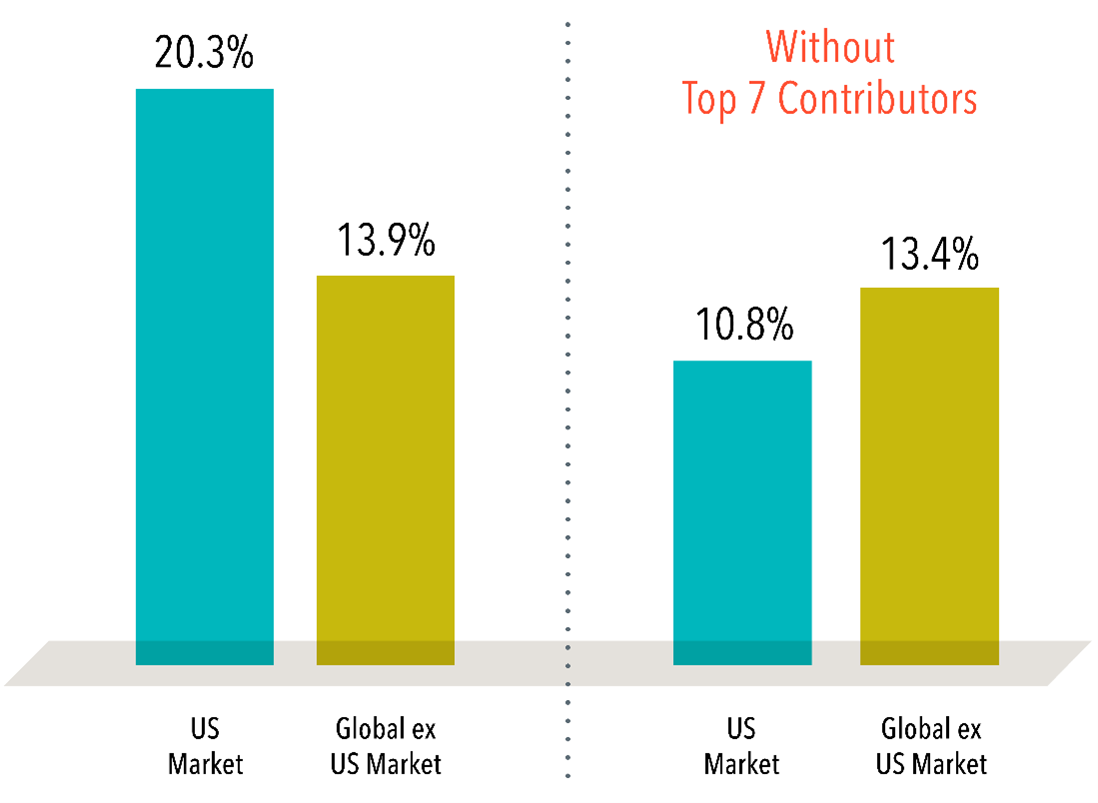

The top seven contributors to the U.S. market—Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta—have returned a collective 66.3%. This accounts for a sizable portion of the Russell 3000 Index’s more-than-six-percentage-point outperformance vs. the MSCI All Country World ex USA Index. Without these seven stocks, the Russell 3000 return falls from 20.3% to 10.8%, which would lag the non-U.S. index with or without its top seven contributors.

Of course, market concentration cuts both ways: benefiting in some periods (like this year) and detracting in others. One of the big selling points for global diversification is reducing your portfolio’s concentration, helping to mitigate the ups and downs from a handful of stocks. For example, the 25 largest U.S. stocks account for about 38% of the Russell 3000 Index but just 23% of the globally diversified MSCI All Country World IMI Index.[1]

EXHIBIT 1

Top-Heavy Performance

Year-to-date cumulative returns as of July 31, 2023

FOOTNOTES

[1] Weights as of June 30, 2023.

Past performance is no guarantee of future results.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. US and global ex US markets represented by, respectively, the Russell 3000 Index and the MSCI All Country World ex USA Index (net dividends). The top seven contributors are the top return contributors specific to each index. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2023, all rights reserved.