By Steve Tepper, CFP®, MBA

Back in 2011, the popular game show Jeopardy hosted its most unusual contestant and, to my knowledge, the only non-human player in the show’s history (criticism of sometimes annoying poker player James Holzhauer notwithstanding). Competing against the show’s two most successful contestants up to that time, Ken Jennings and Brad Rutter, was an IBM supercomputer named Watson.

The folks at IBM had built a language-recognizing computer that could parse the words of trivia clues, search its vast encyclopedia of stored knowledge, and come up with the usually correct answer in nanoseconds, and then was able to beat the human contestants to ring in first and respond with an AI-generated voice.

Watson wasn’t perfect. It thought Toronto was in the United States, and its “What is leg?” response became a meme for about 15 minutes. Nevertheless, by the end of the match, the score wasn’t even close. Watson destroyed its competitors while racking up three times as many points as either of them, as acknowledged by Jennings’ final written response: “I for one welcome our new computer overlords.” (Yes, he wrote that!)

The special three-day show took us inside IBM to see the inner workings and development of this new AI technology, heralding an endless limit of real-world applications—dominating game shows was just the beginning!

It should be no surprise, then, that one of Watson’s subsequent ventures was stock picking. Seems a natural application: make sense of billions of random data elements, process it without emotion, and pick incorrectly priced stocks.

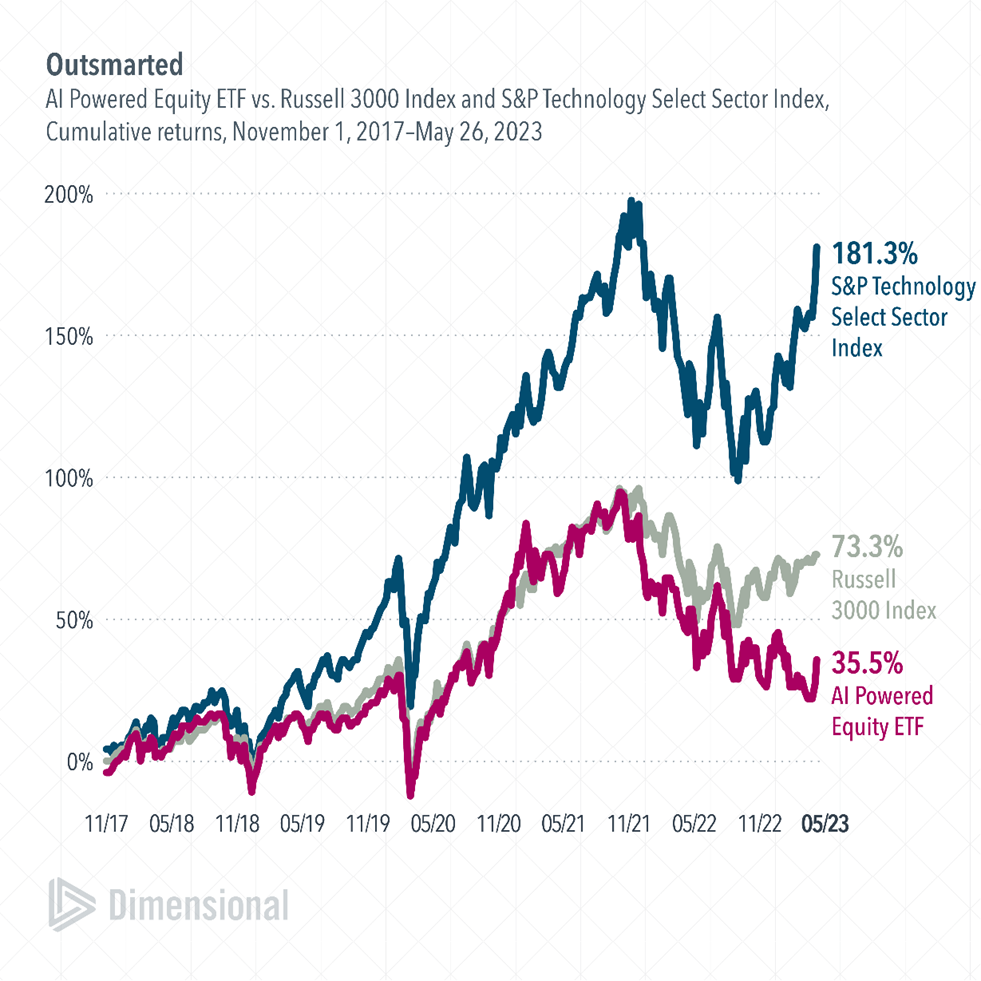

Perhaps it will be a little more surprising that the AI Powered Equity ETF, launched in 2017 using IBM’s AI, has lagged the market over the past six years, giving less than half the return of the broad Russell 3000 index of U.S. funds. It did even worse against stocks in its sector, technology, where it was beat more than five to one! (See graph below.)

Source: Bloomberg. Sample period begins with the first full month of returns for AI Powered Equity ETF.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Playing Monday morning quarterback, I can see at least two major factors contributing to this failure:

Even Watson’s dizzying compendium of human knowledge and response time pales compared to the aggregate wisdom of the millions of individuals trading in the stock market each day. While each of those millions of individuals might be (and probably are) way off, the sum of their predictions often ends up being eerily accurate.

There is an ocean separating the use of knowledge to regurgitate historical fact vs. predicting the future. In fact, the factors that will move stock prices have little to do with past information—that’s factored into the price almost instantaneously by those millions of investors—but by future news and information, which is as unknown to Watson as it is to the rest of us mortals.

This is yet more evidence that there is no method we know of to forecast future stock movement. If the most advanced data processor ever imagined can’t do it, it is folly to believe you can.

Some source material provided by Wes Crill, PhD, Senior Investment Director and Vice President, Dimensional Fund Advisors.