By Steve Tepper, CFP®, MBA

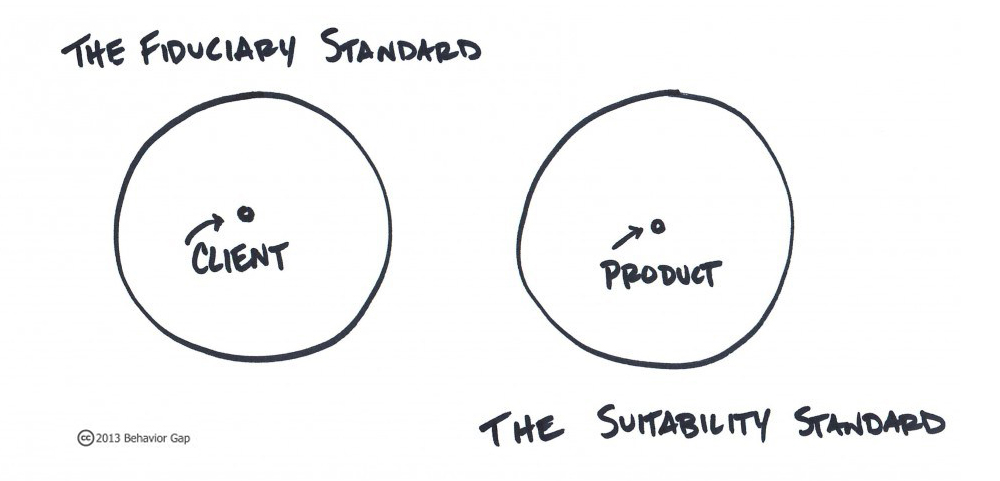

In the financial advising business, few things are as important as being able to define the fiduciary standard to clients and prospective clients. Many people don’t have a clear idea of what the fiduciary standard is—and perhaps more importantly, why it’s critically important to hire a financial advisor who is held to that level of care.

What Is the Fiduciary Standard, Anyway?

The fiduciary standard dates to the Investment Advisers Act of 1940 (aka “The Act”), which, simply put, said that anyone who is in the business of giving financial advice—and who receives compensation for doing so—must always act in the best interests of the client, the person paying them for that advice. That means putting the client’s interest ahead of their own.

That seems simple and logical, but since when is the world simple and logical? There are many exceptions to the rule:

“Hold on there, Federal Government. I’m a CPA who primarily does taxes for my clients but occasionally will give them advice on what to do with their cash and investments. Do I fall under The Act?” Well, no. If financial advice isn’t your principal business, you can have a pass.

“Hey, I’m a journalist. I just write a blog giving general financial advice to many readers. Must I be a fiduciary?” Nah, you’re excused too.

“But I’m a commissioned broker. I don’t charge my client for the advice I give because I get paid by a fund company when I buy a product for the client. If the client isn’t paying me, why should I be held to such a high standard of care?” OK, we’ll let you off the hook too.

And just like that, most people giving financial advice skipped right out from the fiduciary standard. That’s where understanding the difference between standards of care is important.

So, What Does the Commissioned Advisor Exemption Really Mean for Investors?

Under the fiduciary standard, there are many things advisors must or must not do. For example, advisors:

Must select investments that best meet clients’ needs at the lowest cost

Must not select investments based on how much compensation the advisor stands to receive for the sale

Must avoid conflicts of interest

Must obtain “best execution,” finding a broker to conduct trades most efficiently and at low cost

Commissioned advisors fall under a different standard of care, called the suitability rule. If these advisors reasonably believe their recommendations are suitable for a client, they’re good to go.

What’s wrong with that, you ask? Why isn’t it enough to create an investment portfolio filled with suitable investments? That sounds pretty good, right?

In a word: no. It’s not enough; it isn’t even close to enough.

For starters, what’s suitable for a client? Are risky derivatives a suitable investment for an 85-year-old retiree living on a fixed income? The answer is, obviously, “no.” Except when the answer is “yes.” Because the real answer to that question is “maybe.”

In fact, a very risky investment could be shown to be suitable in even the most risk-averse client’s portfolio if it is a small part of the portfolio and can be shown to reduce the overall risk of the portfolio by adding more diversification.

Did that last paragraph make your eyes glaze over? Sorry. Translation: Almost any investment could meet the suitability standard if the portfolio is well-diversified.

But that’s just the start of the potential problems for investors if their advisor is only being held to the suitability standard.

What Commissioned Advisors Can and Can’t Do

While we have a long list of musts and must-nots for advisors under the fiduciary standard, there are a lot of cans and probably wills for commissioned advisors. For example, they:

Can act as the “principal” in a trade with you, meaning they aren’t brokering a sale to, or purchase from, a third party, but selling directly to you from their own portfolio, or buying from you to hold the asset in their own account

Can buy a hot stock for themselves first, then buy it for you after the price has gone up

Can and probably will recommend high-cost funds when similar lower-cost funds are available, because the high-cost funds pay them better

Can and probably will use their own brokerage firm for trades even if they are more expensive than, and don’t get as good market prices as, other brokers

These are big conflicts that can be very costly for the client, but based on the brokerage business model (and their exemption from The Act), there really is no way to avoid them.

Legal Changes in Recent Years

Even if you are not fully enveloped in the world of finance, you may have heard the word “fiduciary” in the news over the last few years. Here’s the condensed version of what was going on: In 2016, the Department of Labor passed a rule requiring all advisors to act as fiduciaries for retirement assets.

If you think that sounds like it was a big deal for the brokerage world, you’d be right. And they fought back. And we had an election and a new administration that was reluctant to enact and enforce the rule. The federal appeals court struck down the decision in 2018, and it was business as usual for brokers.

Earlier this summer, the Department of Labor came out with a new fiduciary standard that essentially returns most of the regulations and exemptions to the pre-Obama-era status quo. Financial advisors returned to a five-part test to determine whether they’re actually a fiduciary, and this list of exemptions allows for at least as many loopholes as before.

Barbara Roper, director of investor protection at the Consumer Federation of America, said the new rule “means firms will essentially be able to choose whether they want to operate under what’s left of the fiduciary standard or disclaim away their fiduciary obligations.”

In a nutshell? We’re essentially back where we started when it comes to the fiduciary standard.

Commissioned advisors who tell you they act in your best interest are just not being honest with you. Only “fee-only” advisors are held to The Act and truly must place your interests ahead of their own.

Schedule a complimentary consultation with a fee-only financial planner to discuss your personal situation in more detail.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Investing risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful.

This material was prepared by Kaleido Inc. from information derived from sources believed to be accurate. This information should not be construed as investment, tax or legal advice.