By Dimensional Fund Advisors

Investors reading their financial news publications of choice over the last year or so may have come across a headline titled something like “How Higher Interest Rates Will Affect the Stock Markets.” These articles typically go on to talk about how higher interest rates lead to higher borrowing costs for companies, which lead to lower profits/valuations and in turn poor equity performance.

However, historical data suggests this is not necessarily the case. Exhibit 1 below plots monthly returns of the U.S. equity risk premium on the vertical axis against monthly returns of the 10-Year U.S. Treasury Yield on the horizontal axis. As illustrated, we don’t observe a discernable relationship between higher bond yields leading to lower equity returns.

Exhibit 1: Monthly Fama/French U.S. Research Market Factor Returns Against the 10-Yr Treasury Yield

July 1963 – March 2022

Past performance is not a guarantee of future results.

In USD. Sources: US Treasury data available from FRED, Federal Reserve Bank of St. Louis. Monthly levels are as of the beginning of the month. Fama/ French Factors shown are provided by Ken French. Factors are not available for direct investment; their performance does not reflect the expenses associated with the management of an actual portfolio. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Please see “Data Appendix—Fama/French Factors” for more information regarding the factors shown.

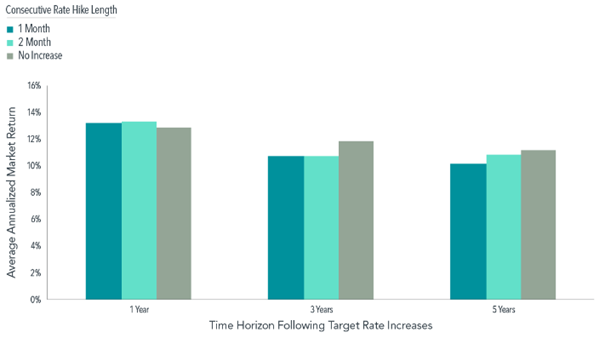

For investors concerned about how upcoming Fed policy decisions might affect future equity returns, Exhibit 2 below may offer some reassuring news. The chart shows average annual equity returns, measured by the Fama/French Total US Market Research Index, following different monthly rate hike scenarios. We see that performance following months in which the Fed raised rates is not meaningfully different from the performance following months without a rate hike.

Exhibit 2: U.S. Equity Market Returns Following Consecutive Fed Funds Rate Hikes

January 1983 – December 2021

Past performance is not a guarantee of future results.

Source: Monthly target federal funds rate data from Federal Reserve Bank of St. Louis. The monthly series reflects the federal funds target rate from January 1983 through December 2008 and the federal funds target range—upper limit (ul) from January 2009 through December 2021. Equity market returns computed using monthly return to the Fama/French Total US Market Research Index, available from Ken French Data Library. There are 70 one-month rate hikes, 28 two-month rate hikes, and 389 months without an increase. Average annualized returns following consecutive rate increases starting at month end; performance time horizons can overlap. The Fama/French Indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” below for descriptions of the Dimensional and Fama/French index data.

All else remaining the same, it might seem logical to think that higher borrowing costs from higher interest rates may lead to lower profits/valuations and in turn poorer equity performance. However, periods of higher interest rates or rate changes don’t happen in isolation, and many other influences can create noise in realized equity returns.

Even if one were able to have perfect foresight of future interest rate movements, the data above suggests this information would be of little help to base short-term investment decisions on. Stock prices continually adjust and respond to new information that is available to investors. Trying to predict all of the different potential sources of information and the magnitude of their impacts in order to make investment decisions is unlikely to lead to a positive investment result in the long term.