By Dimensional Fund Advisors

It’s probably not news to most value investors that the value premium has struggled over the past decade. What might be news is just how extreme an outlier recent value stock underperformance represents.

The periodic returns for value versus growth in Exhibit 1 convey a stark contrast between recent years and the longer run of evidence, suggesting the past decade’s disappointing premium was disproportionally impacted by the last three years.

Over the first seven years of the last decade (July 2010–June 2017), value stocks actually outperformed their prior long-run average return, 14.3% versus 12.8%. However, a substantially stronger-than-average performance from growth stocks (16.6% versus 9.0%) resulted in a negative value premium for this period.

The last three years were a different story. While growth continued to its historically high return, value stocks produced a return of –3.30%, resulting in an annualized value premium of –21.22% over this period.

Exhibit 1: Growth Spurt

Annualized compound returns for value vs. growth, U.S. market

Value and growth stocks represented by the Fama/French Value Research Index and the Fama/French Growth Research Index, respectively. Returns provided by Ken French, available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

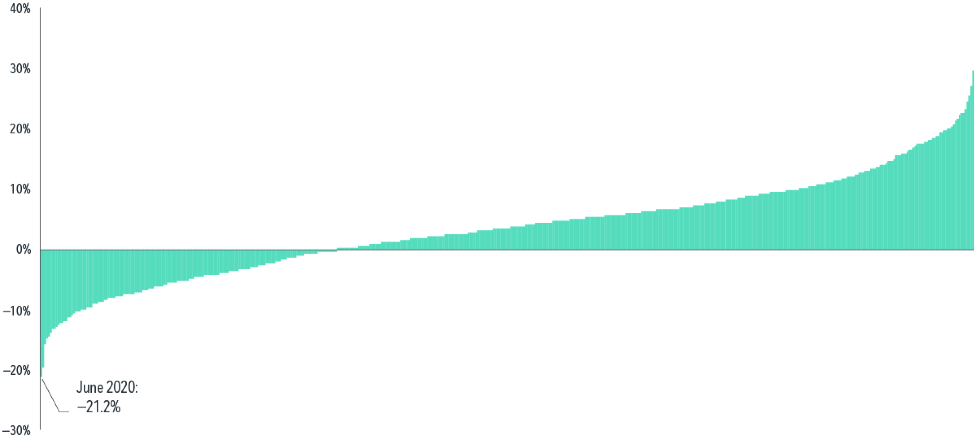

This three-year run warrants further inspection—just how uncommon was this value premium magnitude? Literally unprecedented, as illustrated by the rolling three-year value premiums in Exhibit 2. Of the 1,093 rolling observations in U.S. history, the three years ending in June 2020 ranked dead last. This is the very definition of an outlier.

Exhibit 2: Back of the pack

Rolling 3-year annualized return differences for value

vs. growth, U.S. market, June 1929–June 2020

Past performance is not a guarantee of future results.

Value and Growth represented by the Fama/French US Value Research Index and Fama/French US Growth Research Index, respectively. Fama/French index data available from the data library of Ken French.

Appreciating the extraordinary nature of an observation is important to assessing its implications going forward. A successful entrepreneur becoming a billionaire after dropping out of college does not marginalize higher education as a means to maximizing one’s career earnings potential. Similarly, asset allocation decisions are more reliably informed by a long series of evidence rather than the exception.

An extremely disappointing run of results for value versus growth does not necessarily signal a “new normal” for value. The theoretical premise behind value investing—paying a lower price for expected future cash flows, indicating higher expected returns—is just as valid today as it was 10 years ago. And even strongly negative recent value premiums haven’t offset a preponderance of evidence for positive value premiums spanning nearly a century in the U.S. and more than five decades in non-U.S. markets.

While exceptional observations of the value premium should not erode a belief in value investing, they do serve as a reminder of the variability of realized returns. As Exhibit 3 illustrates, there has been a wide range of outcomes for the premium on a month-to-month basis.

In fact, the distribution tells us that when value shows up, it can show up in bunches. For example, about 1 in 20 months during this period saw a realized value premium of at least 6%, or 20 times the size of the average monthly premium (0.30%).

Exhibit 3: Monthly Statement

Distribution of monthly return differences for value

vs. growth, U.S. market, July 31, 1926–June 30, 2020

Past performance is not a guarantee of future results.

Value and Growth represented by the Fama/French US Value Research Index and Fama/French US Growth Research Index, respectively. Fama/French index data available from the data library of Ken French.

Why is this important for investors (and value strategy managers)? These outsize positive returns are an important component of the long-run positive average value premium. A disciplined focus on value is essential to capturing this source of higher expected returns.

Past performance is no guarantee of future results. International investing involves special risks such as currency fluctuation and political instability.

Growth stocks are stocks trading at a high price relative to a measure of fundamental value such as book equity. Value stocks are stocks trading at a low price relative to a measure of fundamental value such as book equity. Value premium is the return difference between stocks with low relative prices (value) and stocks with high relative prices (growth).

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Northstar accepts no responsibility for loss arising from the use of the information contained herein.